mississippi income tax rate

There is no tax schedule for Mississippi income taxes. Mississippi 3 to 5.

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Your 2021 Tax Bracket to See Whats Been Adjusted.

. 0 on the first 2000 of taxable income. 2021 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. 3 on the next 3000 of taxable income.

The previous 882 rate was increased to three graduated. Mississippi has a graduated tax rate. Mississippi also has a 400 to 500 percent corporate income tax rate.

On top of that the state has low property taxes and moderate sales taxes. Mississippi Income Tax Rate 2022 - 2023. Your average tax rate is.

For more information about the income tax in these states visit the Mississippi and Alabama income tax pages. In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Mississippi Income Tax Calculator 2021.

Tate Reeves on Tuesday signed a bill that will reduce the state income tax over four years beginning in 2023. Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut. Discover Helpful Information and Resources on Taxes From AARP.

Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are also considering cuts or elimination. 4 on the next 5000 of taxable income. Mississippi state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with MS tax rates of 0 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Combined Filers - Filing and Payment Procedures. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. 2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

But if legislators take no action the tax rate will remain at 4. Mississippi one of the poorest states in the nation has struggling rural hospitals and perpetually underfunded schools. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget.

This tool compares the tax brackets for single individuals in each state. Eligible Charitable Organizations Information. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

Income tax is a tax that is imposed on people and businesses based on the income or profits that they earned. Detailed Mississippi state income tax rates and brackets are available on this page. Mississippi residents have to pay a sales tax on goods and services.

Ad Compare Your 2022 Tax Bracket vs. The tax rates are. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Use this tool to compare the state income taxes in Mississippi and Alabama or any other pair of states. The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket. AP Mississippi residents will pay lower income taxes in coming years as the state enacts its largest-ever tax cut.

Mississippis SUI rates range from 0 to 54. However the statewide sales tax of 7 is slightly above the national average. If youre married filing taxes jointly theres a tax rate of 3 from 4000 to 5000.

Mississippi Income Tax Forms. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Residents of Mississippi are also subject to federal income tax rates and must generally file a federal income tax return by April 17 2023.

Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent. First and foremost is the way it treats retirement income. Hurricane Katrina Information.

For income taxes in all fifty states see the income. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Mississippi exempts all forms of retirement income from taxation including Social Security benefits income from an IRA income from a 401k and any pension income. Corporate Income Tax Division.

Mississippi State Income Tax Forms for Tax Year 2021 Jan. Mailing Address Information. For context even with the individual income tax intact Mississippis state and local revenue per capita is the 4th lowest in the nation.

The Mississippi tax rate and tax brackets changed from last year dropping the 3 bracket. The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes. Reduce state income tax revenue by 525 million a year starting in 2026.

5000 and 10001. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Mississippi sales tax rates. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent. Tate Reeves on Tuesday signed a bill that.

We dont make judgments or prescribe specific policies. Gunn said he anticipates the governor will sign the legislation and like him continue to work to eliminate the income tax. The Mississippi Single filing status tax brackets are shown in the table below.

Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Details on how to only prepare and print a Mississippi 2021 Tax Return.

These income tax brackets and rates apply to Mississippi taxable income earned January 1 2022 through December 31 2022. The individual income tax brings in more than 18 billion or 325 percent of General Fund dollars. 5 on all taxable income over 10000.

The state sales tax rate in Mississippi. When the plan is fully phased in Gunn said Mississippi will have the 5 th lowest marginal rate of the 41 states with a personal income tax. The graduated income tax rate is.

Corporate and Partnership Income Tax Help. See what makes us different. These rates are the same for individuals and businesses.

The taxable wage base in 2022 is 14000 for each employee.

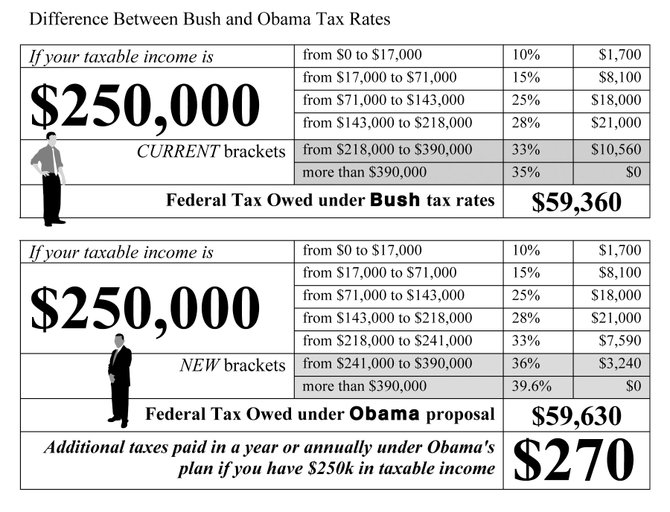

Taxes Obama Vs Bush Rates Jackson Free Press Jackson Ms

Tax Rates Exemptions Deductions Dor

As More Americans Move To No Income Tax States More Lawmakers Move To Phase Out State Income Taxes

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

Strengthening Mississippi S Income Tax Hope Policy Institute

Mississippi Tax Rate H R Block

Mississippi Income Tax Calculator Smartasset

Historical Mississippi Tax Policy Information Ballotpedia

States With Highest And Lowest Sales Tax Rates

The Most And Least Tax Friendly Us States

State Corporate Income Tax Rates And Brackets Tax Foundation

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Mississippi Tax Rate H R Block

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Mississippi Who Pays 6th Edition Itep

State Corporate Income Tax Rates And Brackets Tax Foundation

Individual Income Tax Structures In Selected States The Civic Federation